Zurich, 16 August 2017

BlueOrchard conducted a field trip for a delegation of potential investors and leading Swiss real estate representatives to get first-hand information on the real estate sector and meet local partners in Georgia on 12-15 August 2017.

Driven by strong macroeconomic fundamentals, favorable demographics and urbanization, the need for affordable and energy efficient real estate in Georgia is on the rise. It is within this context that a high-caliber delegation of potential investors and leading Swiss real estate representatives conducted a three-day trip to inspect various projects and meet local partners and industry representatives with the aim of fostering relationships and exploring opportunities for business and investment in the real estate sector in Georgia.

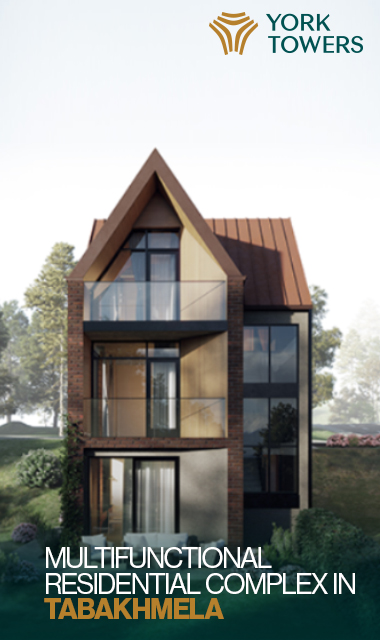

As previously announced, BlueOrchard will launch in autumn the Caucasus Real Estate Fund providing energy- efficient and climate neutral property investments in the Caucasus region. The energy efficiency of the building stock in Georgia is low, offering ample opportunity for savings and CO2 reduction. Furthermore, low vacancy rates, shortage of quality real estate and high yields promise attractive financial returns for investors. With its new fund, BlueOrchard unlocks the significant potential for enhancing energy efficiency through upgrading of existing and development of new properties in Georgia.

In July, BlueOrchard acquired TERNES Real Estate Fund, the pioneer in collective real estate investments in Georgia which gradually passes into BlueOrchard’s real estate activities and broadens the firm’s sustainable infrastructure investment expertise. TERNES Real Estate Fund was founded by Dr. Sascha Ternes, who has joined BlueOrchard as Senior Vice-President Real Estate. Sascha has over 20 years of experience in emerging markets, real estate and finance. He resides in Tbilisi since 2007, where he initially served as CFO and later as CEO of ProCredit Bank Georgia and subsequently as Deputy CEO of Bank of Georgia. BlueOrchard opened a local office in Tbilisi in 2013, and currently has a team of 14 staff on-site.

“Georgia has undergone transformative changes in the past decades, progressively developing its economy and offering attractive investment opportunities. We are excited to work together with our strong network to take a leading role in addressing the development challenges within Georgia” says Peter A. Fanconi, Chairman of the Board of BlueOrchard.

For further information, please contact: Tahmina Theis +41 44 441 55 50 [email protected] www.blueorchard.com

BlueOrchard Finance is a leading global impact investment management firm dedicated to fostering inclusive and sustainable growth while providing attractive returns for its investors. BlueOrchard offers premium multi-asset class solutions and is an expert in innovative blended finance and public-private-partnership mandates. With a major presence in emerging and frontier markets and offices on four continents, BlueOrchard helps its partners around the world make profound investment decisions and meet their objectives.

Founded in 2001 by initiative of the UN, BlueOrchard was the first commercial manager of microfinance debt investments. The firm has utilized its know-howand experience to steadily expand into asset classes including credit, private equity, and sustainable infrastructure. To date, BlueOrchard has invested more than USD 4bn across 70 emerging and frontier markets, enabling fundamental social impact. BlueOrchard Finance is a licensed Swiss asset manager authorized by the FINMA. Its Luxembourg entity is a licensed alternative investment fund manager (AIFM) authorized by the CSSF.

For additional information, please visit: www.blueorchard.com

Zurich • Geneva • Luxembourg • Lima • PhnomPenh • Tbilisi • Nairobi